search our articles:

The Best Supplements for Whatever You’re Feeling

When you want to feel fantastic, you have to make a few changes. Implementing some supplements into your routine can help you feel healthy and

SELF CARE

6 Ways to Live Sustainably

Based on a recent study conducted by Southern Cross University, 93% of people in America and Australia share a general concern for the environment. Of that

5 Ways You Can Improve Your Health Without Leaving the House

It has never been more important to take care of your physical and mental health. Human health relies so much on social interaction. Social relationships are consistently

3 Celebrity Anti-Aging Secrets

When it comes to taking care of yourself, part of this care is portrayed through how you look. Many feel like they want to minimize

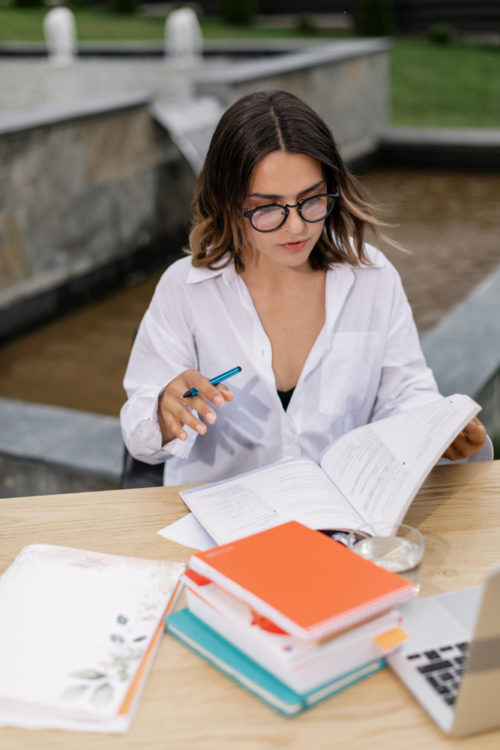

Team Osengarten

While DrOsengarten.com originally began as a one-woman show, it would not be what it is today without the support, knowledge, talent, and passion of the field experts who make up Team Osengarten. Let’s meet the team!Meet the Doctor

Learn a little bit more about Dr. O and her experience, background, and life inside and out of DrOsengarten.com.

Learn More

Love what you see here on DrOsengarten.com? Learn more about our community and share your own insights with the team!

Contact our Experts

Have inquiries or suggestions for our team? We love to hear from our dedicated readers. Click above for more information.